Can lab grown diamonds be insured?

Key Takeaways:

- Coverage options for lab grown diamonds provide insurance protection for these valuable pieces.

- Accurate appraisal of lab grown diamonds is crucial for obtaining proper insurance coverage.

- Specialized jewelry insurance policies offer affordable and reliable coverage for lab grown diamonds.

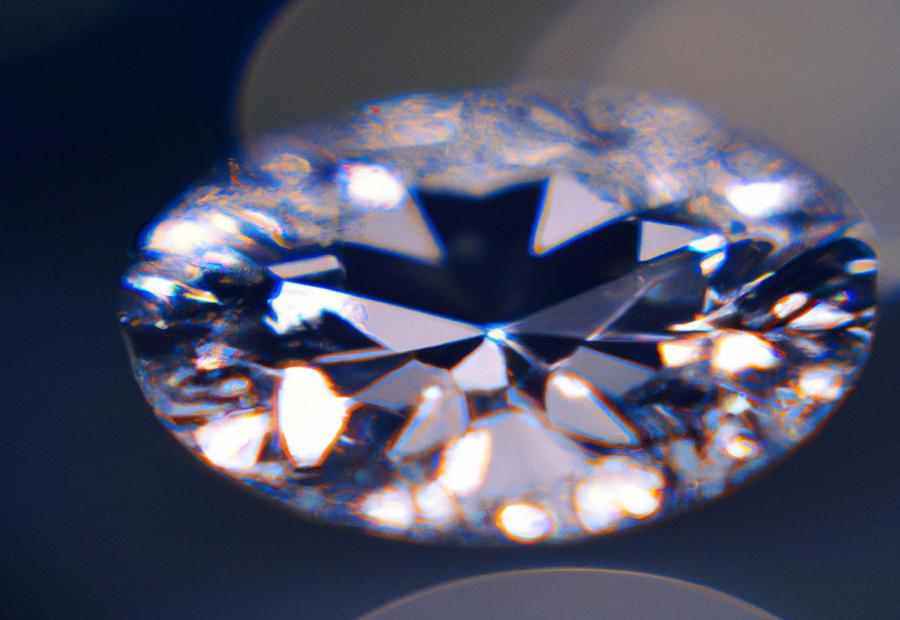

Photo Credits: Www.Lab-Grown-Diamond-Ring.Com by Jesse Baker

Insuring your valuable jewelry, such as lab-grown diamonds, is crucial in protecting your investment. In this section, we will explore the importance of insuring fine jewelry and the distinctions between insurance policies and warranties. Discover how insurance can provide you with peace of mind and ensure that your prized possessions are safeguarded.

Importance of insuring fine jewelry

Fine jewelry holds great value – both monetarily and sentimentally. So, protecting it with insurance is essential. Coverage can be provided for theft, loss or damage, so the owner is compensated for their investment. Replacing or repairing jewelry can be costly, so insurance offers peace of mind.

Lab-grown diamonds also need coverage due to their popularity in the market. Though similar to natural diamonds, they are usually lower-priced. Insurance tailored to them properly reflects their market value. Appraisal is key to getting the right insurance coverage for both jewelry and lab-grown diamonds. Accurate appraisal takes into account carat weight, cut, color and clarity. Without this, underinsurance or inadequate compensation is a risk.

When looking at insurance options, compare different policies and providers. Homeowners insurance can cover jewelry, but may need a rider for comprehensive coverage. Specialized jewelry insurance provides additional protection and can offer benefits such as worldwide coverage and higher policy limits. Use an experienced jewelry insurance provider who has expertise in valuables like lab-grown diamonds.

Insurance cost for fine jewelry depends on the collection value and where it’s stored when not worn. For lab-grown diamonds, insurance premiums are usually lower than for natural diamonds. This is because they are priced more affordably.

Distinction between insurance policies and warranties

Insurance policies and warranties are two different forms of protection for fine jewelry. Insurance covers loss, damage, or theft, while warranties give guarantees from the manufacturer about defects or certain types of damage.

- Insurance covers a wider range of risks than warranties.

- Insurance requires you to pay premiums, while warranties usually come with the purchase.

- You can get insurance from a jewelry insurance provider or add it to homeowners insurance.

- Warranties are usually offered when you buy the jewelry.

- Insurance pays you based on the jewelry’s value, while a warranty may offer repair or replacement.

- Insurance needs more documentation and appraisal than warranties.

It’s important to remember that insurance and warranties protect jewelry in different ways and have different levels of coverage. You need to assess your needs and pick the right protection for you. Plus, lab grown diamonds now make the insurance game even sparklier.

Insuring Lab Grown Diamonds

Photo Credits: Www.Lab-Grown-Diamond-Ring.Com by Scott Ramirez

Insuring lab-grown diamonds is crucial in protecting your investment. Discover the coverage options available and learn about the advantages of insuring lab-grown diamonds. Ensure that your precious lab-grown diamonds are protected with the right insurance coverage.

Coverage options for lab grown diamonds

Let’s delve deeper into lab grown diamond coverage options. Key factors to consider when choosing an insurance policy include:

- Evaluation: An appraisal from a certified jeweler or gemologist who specializes in lab grown diamonds may be required to determine the value and eligibility of the diamond for coverage.

- Replacement Cost: Some insurance policies provide full replacement cost coverage, while others provide reimbursement based on predetermined values. It’s important to read policy details to ensure sufficient coverage.

- Exclusions: Exclusions such as damage caused by wear and tear, mishandling, or intentional acts may be included in the policy. Make sure to read and understand these exclusions before purchasing.

Having proper coverage for lab grown diamonds offers peace of mind. With an understanding of relevant factors and careful review of insurance policies, individuals can make informed decisions to protect their investment.

Advantages of insuring lab grown diamonds

Insuring lab grown diamonds offers many advantages. Key amongst them is the option to get coverage specially designed for these gems. These policies provide protection from theft, damage, and loss – giving peace of mind to the diamond owner.

To further emphasize the benefits of insuring lab grown diamonds, here are three points to consider:

- Insurance provides monetary compensation if anything bad happens, like damage or loss. This means the owner won’t suffer financially and can easily replace or repair their diamond.

- Insuring lab grown diamonds also helps to get an accurate assessment. Knowing the value is important for insurance purposes. Insurance companies often demand an up-to-date appraisal to ensure enough coverage. This increases transparency between policyholder and insurer.

- Lab grown diamonds are more affordable than natural diamonds, but still valuable. Insuring them offers protection in case of any unexpected occurrences. Specialized jewelry insurance policies, made just for lab grown diamonds, are available – allowing owners to get appropriate coverage at reasonable rates.

Appraisal and Assessment

Photo Credits: Www.Lab-Grown-Diamond-Ring.Com by Logan Clark

Accurately appraising lab-grown diamonds is crucial for insurance purposes and ensuring proper coverage. Let’s dive into the importance of precise assessments and the need to understand the value of lab-grown diamonds when it comes to insurance.

Importance of accurate appraisal for insurance purposes

Accurately appraising fine jewelry, especially lab-grown diamonds, is essential for insurance purposes. An exact valuation guarantees the jewelry is properly insured in case of loss, damage, or theft. Incorrectly assessing the value can lead to financial losses for the policyholder.

Besides determining worth, an accurate appraisal verifies the authenticity and quality of lab-grown diamonds. These ethical and sustainable diamonds have become popular lately. But, their value may differ depending on factors like size, color, clarity, and cut. An appraisal is necessary to decide the real value and ensure correct coverage.

It is important to remember that appraising lab-grown diamonds is a bit different from natural diamonds. While these two types share similarities, they also have distinct features that affect value. Thus, considering these characteristics during the appraisal process is important.

Ensuring proper coverage for lab grown diamonds

Ensuring proper coverage for lab grown diamonds is crucial. Appraisal is key to determine their value for insurance purposes. It’s essential to precisely assess the replacement cost and secure adequate coverage.

Insuring lab grown diamonds has its benefits. They are becoming popular for being affordable and ethical. Insurance provides financial security against loss, damage or theft, giving assurance to the owners.

Comprehending the similarities and differences between lab grown and natural diamonds is important. Although they have the same physical properties, their values may differ. Insurance should reflect the true worth of lab grown diamonds.

Various insurance options exist for proper coverage. Including a rider to homeowners insurance can provide some protection, yet specialized jewelry insurance is recommended. It is advisable to select a reliable jewelry insurer that covers lab grown diamonds.

The cost of jewelry insurance depends on the value and rarity of lab grown diamonds. Although premiums may vary, insuring lab grown diamonds is usually affordable. Taking advantage of available insurance options is important.

Comparison with Natural Diamonds

Photo Credits: Www.Lab-Grown-Diamond-Ring.Com by Thomas Jackson

Lab grown diamonds have been an intriguing addition to the jewelry industry, but how do they compare to natural diamonds? In this section, we’ll explore the similarities and differences between lab grown and natural diamonds, as well as the insurance considerations for both types. Discover the fascinating comparisons and important factors to consider when it comes to insuring these precious gemstones.

Similarities and differences between lab grown and natural diamonds

When it comes to insuring both lab grown and natural diamonds, it is vital to understand their similarities and differences. They have the same physical characteristics, such as hardness and brilliance, making them indistinguishable with the eye. Yet, there are distinctions in origin and value.

To shed light on the subject, here are the main points of comparison between lab grown and natural diamonds:

Similarities:

- Physical Properties: Both kinds of diamonds are made up of the same chemical composition.

- Aesthetics: They both have the same beauty and allure.

Differences:

- Origin: Natural diamonds are formed by nature, while lab grown diamonds are made in a laboratory.

- Rarity: Natural diamonds are rare, so they cost more. Lab grown diamonds can be made in larger quantities, thus they are more affordable.

- Price: Natural diamonds are pricier due to lack of availability. Lab grown diamonds are less expensive.

- Sustainability: Lab grown diamonds are more eco-friendly since they don’t require extensive excavation or cause harm to the environment.

It is essential to acknowledge that insurance policies may have different terms and conditions for lab grown and natural diamonds. Some insurance companies provide various coverage options and premiums based on these distinctions. That’s why those looking to insure either type of diamond should look into their insurance policies or talk to specialized jewelry insurance providers in order to get tailored coverage that meets their specific needs. This ensures protection of their investment in either lab grown or natural diamonds.

Insurance considerations for both types of diamonds

Insuring lab grown and natural diamonds is vital for coverage and security. When insuring either, there are a few key factors to consider.

- Options for coverage may include specialized jewelry insurance policies or adding a rider to homeowners insurance. These offer protection from theft, loss, and damage.

- Accurate appraisal is essential for determining the insured value of the diamond. This ensures the market value is reflected in the coverage.

- Costs for insuring diamonds may depend on the value, location, security measures, and previous claims. Considering these factors will guarantee proper coverage and assurance.

Insurance Options

Photo Credits: Www.Lab-Grown-Diamond-Ring.Com by Stephen Taylor

When it comes to insuring lab-grown diamonds, there are various options to consider. From adding a rider to your existing homeowners insurance, to specialized jewelry insurance policies, to choosing a recommended jewelry insurance provider – we’ll uncover the range of insurance options available for protecting your valuable lab-grown diamonds.

Adding a rider to homeowners insurance

To secure proper coverage for your lab grown diamonds, first determine their value with a professional appraisal. Knowing their worth is important. Then contact your homeowners insurance provider.

Ask about adding a rider to insure your diamonds. Provide the paperwork, including the appraisal. When they approve the rider, pay the additional premium. Review the policy details. Check the coverage limits, deductibles and any exclusions.

Adding a rider to your policy gives peace of mind. You’ll sleep soundly knowing your diamonds are covered. So ensure their protection with your homeowners insurance.

Specialized jewelry insurance policies

Have you considered specialized jewelry insurance for your lab grown diamonds? It usually has higher coverage limits than standard homeowners or renters insurance, and may cover a wider range of scenarios like loss while travelling and mysterious disappearance. Plus, you can be more flexible with coverage options, and deductibles can be lower too!

Look out for additional services from some specialized insurance providers, such as complimentary appraisals, cleaning and repair assistance.

But, remember to check policy details before purchasing. And never gamble with your gems – choose the right insurance provider for your prized possessions!

Recommended jewelry insurance provider

Insuring lab-grown diamonds calls for a specialized provider. They know the value and qualities of these stones, so they can tailor coverage. Plus, they have appraisal techniques made just for lab-grown diamonds. Partnering with a recommended jewelry insurer means protection for precious stones. And hey – insuring jewelry is like investing in laughter! Premiums will truly sparkle with a bit of humor.

Cost of Jewelry Insurance

Photo Credits: Www.Lab-Grown-Diamond-Ring.Com by Noah Sanchez

The cost of insuring your jewelry, including lab-grown diamonds, depends on various factors. In this section, we’ll explore the key elements that influence insurance costs for jewelry, and also discuss the average cost associated with insuring lab-grown diamonds. Discover how these factors can impact your decision-making when it comes to protecting your precious jewelry investments.

Factors influencing insurance costs

It’s important to consider factors when getting insurance for lab-grown diamonds. That way, you can get sufficient coverage at a good price. By understanding how these variables affect insurance costs, folks can make informed choices about their policy.

For instance, a lab-grown diamond owner in a high-risk area found that their insurance was more expensive than others in low-risk areas. This was due to differences in crime and the perceived risk of keeping valuable assets there. Despite the higher cost, the owner felt it necessary to insure their diamonds for peace of mind and protection from possible loss or damage.

Average cost of insuring lab grown diamonds

The cost of insuring lab grown diamonds is affected by many factors. Get the diamonds accurately appraised to get proper coverage.

A comparison table can show the insurance costs for lab grown diamonds, with columns for coverage, advantages, and the average cost of insurance.

Insuring lab grown diamonds is an affordable option. There are insurance plans tailored for them, like adding a rider to homeowners insurance, or specialized jewelry policies.

Accurate appraisal is essential in working out the right coverage and cost. Don’t forget, lab grown diamonds can vanish faster than your ex’s phone number – insuring them is wise.

Conclusion

Photo Credits: Www.Lab-Grown-Diamond-Ring.Com by Edward Lewis

Insuring lab grown diamonds comes with its own set of benefits and affordable options. Let’s dive into the conclusion of this discussion, exploring the advantages of insuring lab grown diamonds as well as the availability of insurance options that cater specifically to these unique gems.

Benefits of insuring lab grown diamonds

Insuring lab grown diamonds provides many advantages for the owner. Financial protection in case of loss, theft, or damage is included, plus liability coverage should the diamond cause any injury or damage to someone else’s property. Peace of mind is granted, knowing that the valuable asset is protected. Appraisal may also help determine the diamond’s value and authenticity. Replacement or repair options are available in case of unforeseen circumstances. Transferring risk to the insurance provider can also help avoid financial burden.

Compared to natural diamonds, lab grown diamonds are more affordable. This translates to more economical insurance premiums with adequate coverage. Insuring lab grown diamonds is thus a practical choice for those wanting to protect their investment without straining their budget.

Affordable insurance options for lab grown diamonds.

Lab grown diamonds offer cost-effective insurance options than natural diamonds. These options cover damages, losses, and thefts. Here are some key points to consider when choosing affordable insurance for lab grown diamonds:

- Specialized jewelry coverage: There are policies specially designed for lab grown diamonds. These policies provide protection from various risks, including accidental damage, loss, or theft. They guarantee the full value of your diamond is safe.

- Homeowners insurance rider: You can add a rider or endorsement to an existing homeowners policy. This way, you can include your lab grown diamond in the policy’s coverage. Make sure to review the maximum limits and deductible.

- Coverage options: Insurance providers offer various coverage options for lab grown diamonds. These could be replacement cost coverage, agreed value coverage, or actual cash value coverage. Each option has its own benefits and considerations.

- Average cost: The cost of insuring lab grown diamonds depend on factors such as size, quality, and value. Generally, lab grown diamonds are more affordable to insure due to their lower market value.

- Recommended provider: Choose a reliable and affordable provider with experience in insuring fine jewelry. Research and compare different providers to make sure you get the best coverage.

Some Facts About Lab-Grown Diamond Insurance:

- ✅ Lab-grown diamonds can be insured, just like natural diamonds. (Source: Soha Diamond Co.)

- ✅ Jewelers Mutual is a preferred insurance provider for lab-grown diamonds. (Source: Soha Diamond Co.)

- ✅ Insuring lab-grown diamonds can result in lower insurance premiums due to their lower cost. (Source: Soha Diamond Co.)

- ✅ It is important to have lab-grown diamonds accurately appraised for insurance purposes. (Source: Jewelers Mutual)

- ✅ Specialty jewelry insurance policies like BriteCo offer worldwide coverage for lab-grown diamonds with no deductible. (Source: BriteCo)

FAQs about Can Lab Grown Diamonds Be Insured?

Can lab grown diamonds be insured?

Yes, lab grown diamonds can be insured just like natural diamonds. It is recommended to insure lab grown diamonds, especially considering their value and the potential for loss or damage.

What types of insurance policies cover lab grown diamonds?

Lab grown diamonds can be covered by specialty jewelry insurance policies. These policies, such as BriteCo, offer worldwide coverage for loss, theft, damage, or mysterious disappearance of lab grown diamond jewelry.

Are lab grown diamonds considered real diamonds?

Yes, lab grown diamonds are considered real diamonds as they have the same physical and optical properties as natural diamonds. The only difference is their method of formation.

What is the cost of insuring lab grown diamonds?

The cost of insuring lab grown diamonds varies depending on the location and appraised value of the jewelry. On average, jewelry insurance costs between 0.5% and 3% of the appraised value per year. BriteCo, for example, offers insurance for a $5,000 lab grown diamond ring for under $5.00 a month.

Can lab grown diamond rings be covered by standard homeowners policies?

Standard homeowners policies often provide limited coverage for jewelry, including lab grown diamond rings. It is recommended to consider specialized jewelry insurance, such as BriteCo, for comprehensive coverage of your lab grown diamond ring.

How do I file a claim for a lab grown diamond jewelry?

If you have a lab grown diamond jewelry and need to file a claim for loss, theft, damage, or mysterious disappearance, you can contact your jewelry insurance provider, such as BriteCo. They will guide you through the claim process and provide assistance to ensure you receive an accurate repair or replacement.

Leave a Reply